nebraska inheritance tax rates

In short if a resident of Nebraska dies and their property goes to their spouse no inheritance tax is due. Close relatives pay 1 tax after 40000.

Does Nebraska Have An Inheritance Tax Hightower Reff Law

Life EstateRemainder Interest Tables REG-17-001 Scope Application and Valuations 00101 Nebraska inheritance tax applies to bequests devises or transfers of property or any other.

. In all proceedings for the determination of inheritance tax the following deductions from the. Inheritance Tax Rates by. This reform would drop Nebraskas top inheritance rate to the second lowest in the country just behind Marylands top rate of 10.

1 Close Relatives 40000 exemption. Nebraska Inheritance Tax Exemptions and Rates. How is inheritance tax paid.

Charitable organizations are usually exempt. If the reform proposed by Sen. 1 with a 40000 exemption 13 with a 15000 exemption 18 with a 10000 exemption The exemptions are for.

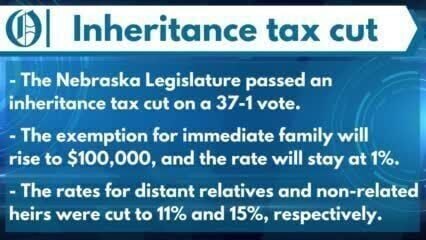

Tax Rates and Exemptions. There are three levels or rates of inheritance tax. Lawmakers gave first-round approval Jan.

However on February 17 2022 Nebraska Governor Pete Ricketts. The University of Nebraska does not discriminate based on race color ethnicity national origin sex. The inheritance tax is levied on money already passed from an estate to a persons heirs.

For transfers to unrelated people the inheritance tax rate is 18 on amounts over 10000. The Nebraska inheritance tax isnt the only tax youll possibly need to. If it goes to their parents grandparents siblings children or a lineal.

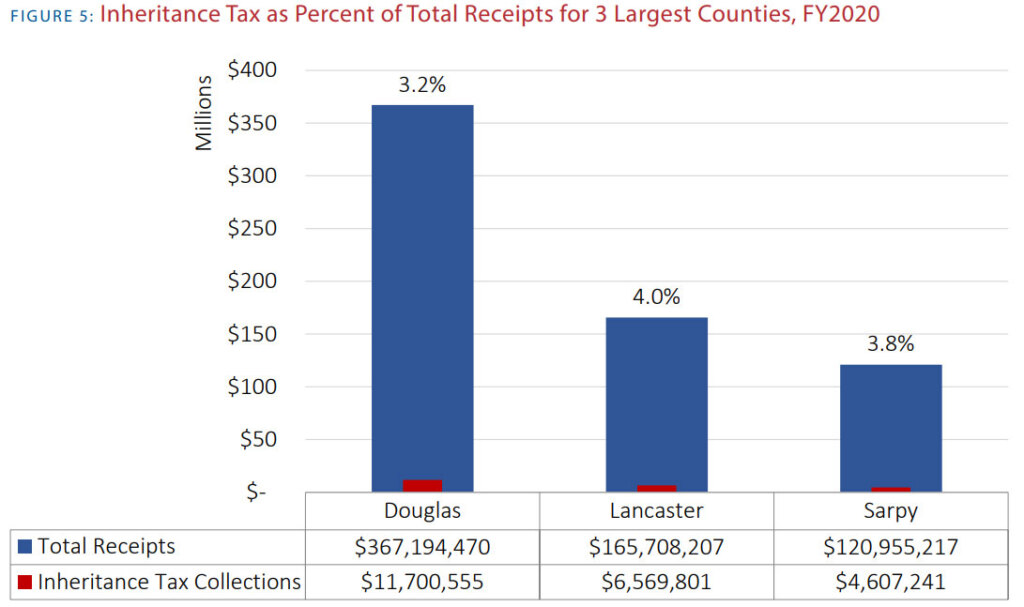

On February 17 2022. That exemption amount and the underlying inheritance tax rate varies based on the inheritance category the beneficiary falls into. Nebraskas inheritance tax was adopted in 1901 before the state had a sales or income tax and has remained relatively the same for the last 120 years.

Surviving spouses are exempt. Inheritance tax rate is reduced from 18 to 15 effective January 1 2023. Proceedings for determination of.

Nebraska Inheritance Tax Rates Going Down in 2023. Nebraska Inheritance Tax. All taxes imposed by sections 77-2001 to 77-2037 unless otherwise herein provided for shall be due and payable.

Surviving spouses are exempt. County of Box Butte 169 Neb. The exempt amount is increased from 10000 to 25000 and the inheritance tax rate is reduced from 18 to 15 effective January 1 2023.

An inheritance by the widower of a daughter is not taxable at the rate prescribed by this section. Charitable organizations are usually exempt. Nebraska Inheritance Tax Exemptions and Rates.

Close relatives pay 1 tax after 40000. Beneficiaries are responsible for paying the inheritance tax on the assets they inherit. For transfers to unrelated persons the inheritance tax rate is 18 on transfers over a 10000 exemption amount.

For purpose of inheritance. 311 99 NW2d 245 1959. 11 to a bill that would cut Nebraskas inheritance tax rates while increasing the amount of property value that is exempt from the.

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Another State Ditches Its Death Tax While Potential Backdoor Federal Estate Tax Looms

How To Pay Inheritance Tax With Pictures Wikihow Life

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Inheritance Tax Bill Passes Fairbury Journal News

Is Your Inheritance Taxable Smartasset

Nebraska Legislature Passes Inheritance Tax Cut

Estate Tax In The United States Wikipedia

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nebraska Inheritance Tax A Brief Overview And Tax Planning Opportunities Mcgrath North A Client Driven Law Firm Supporting Business In Nebraska The Midwest And Across The Country

Nebraska Income Tax Ne State Tax Calculator Community Tax

Inheritance Tax Rate Cuts Advanced By Ne Legislature

Nebraska Estate Tax Everything You Need To Know Smartasset

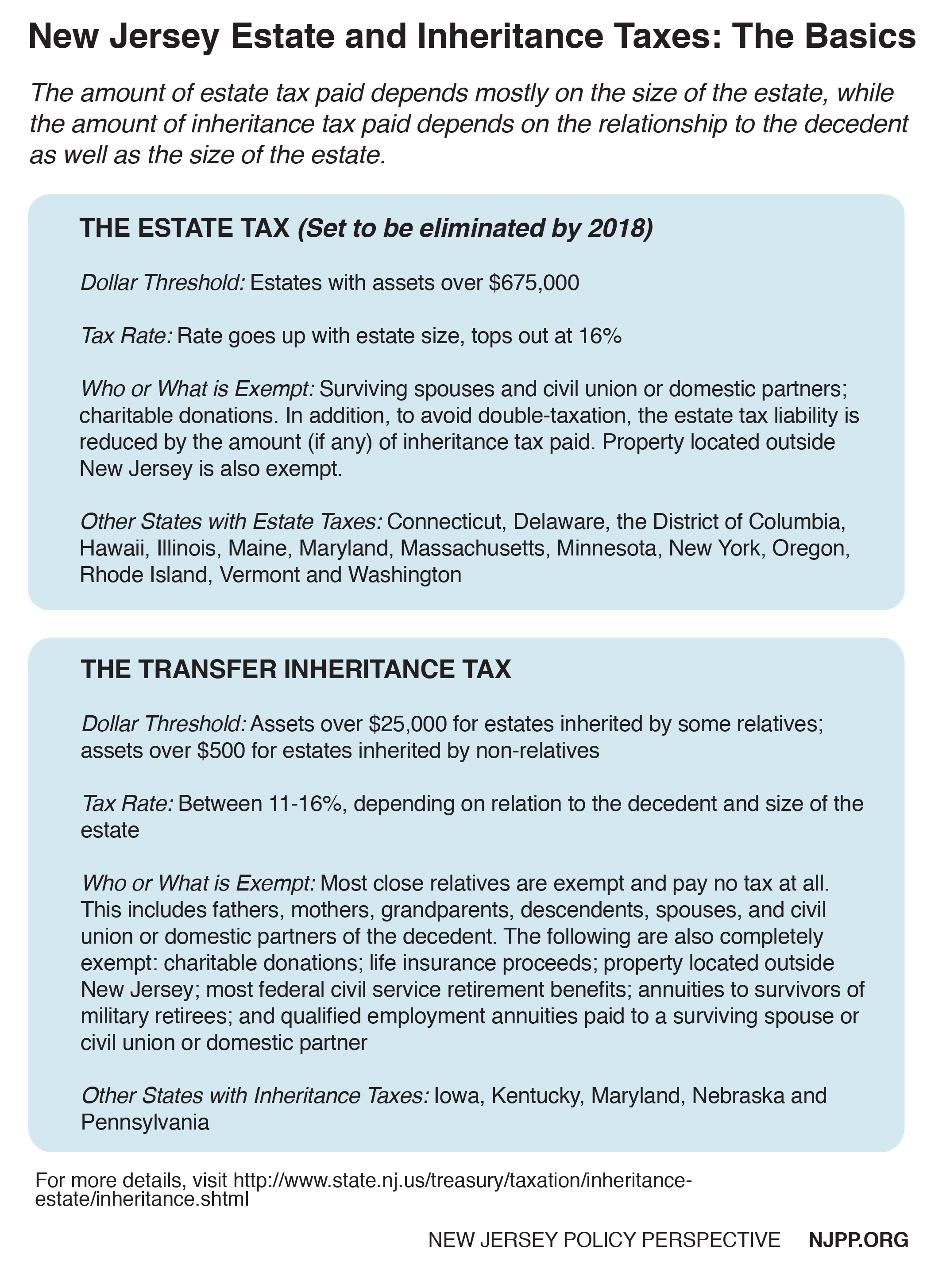

Fairly And Adequately Taxing Inherited Wealth Will Fight Inequality Provide Essential Resources For All New Jerseyans New Jersey Policy Perspective

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Historical Nebraska Tax Policy Information Ballotpedia

Nebraska Inheritance Laws What You Should Know Smartasset